In last year’s September/October issue of Tax Executive, we looked to Thomson Reuters ONESOURCE’s 2018 European Tax Technology Report to identify criteria that tax professionals consider when looking for technology solutions to support their roles within their organizations. In this issue, we go back to that report, but this time we look at something perhaps more relevant: how tax professionals view their current adoption of tax technology.

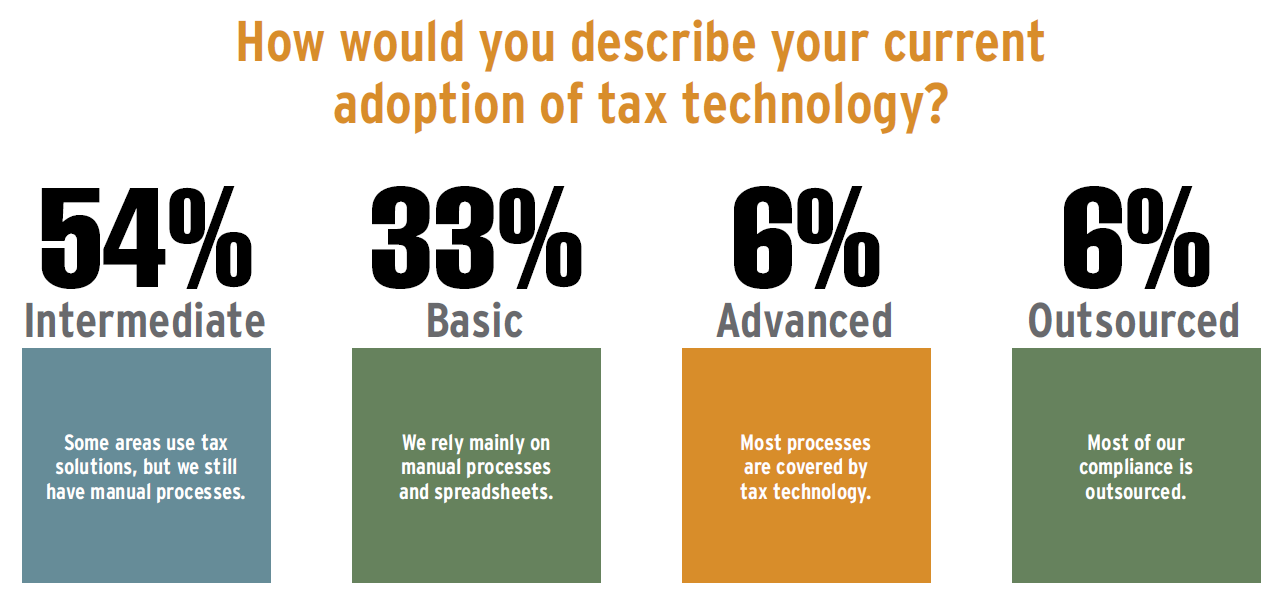

Although this report is now over a year old, it may be fair to evaluate where your company stands with integrating technology into your tax functions. As you’ll see below, about one-third of respondents still rely mainly on manual processes and spreadsheets. So, how do you rate your company on the scale below, and what functions make the most sense for your company to integrate? There is no better time than now to think about—and act on—making your tax department more efficient and effective.

The following survey question and answers appeared in the Thomson Reuters ONESOURCE 2018 European Tax Technology Report. Thomson Reuters conducted this survey in Autumn 2017 across Europe, with a total of 329 completed surveys.