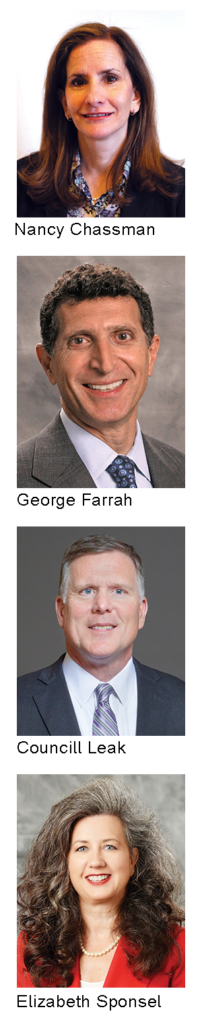

The Tax Cuts and Jobs Act is not “new” anymore. But compliance with an ever-evolving set of regulations and guidance is still on the front burner for corporate tax professionals—and is likely to stay there for quite a while. As with so many tax issues, the best way to ensure compliance is to make a checklist. In the case of the TCJA, however, that’s easier said than done. We put together a roundtable of experts to find out their thoughts about how to develop that checklist. They are Nancy Chassman, partner at Roberts & Holland LLP; George Farrah, vice president of content and analysis at Bloomberg Tax; Councill Leak, senior vice president and tax director at Leidos; and Elizabeth Sponsel, partner and national leader, corporate tax office, at RSM US LLP. The roundtable, which took place in November 2018, was moderated by Michael Levin-Epstein, senior editor of Tax Executive.

The Tax Cuts and Jobs Act is not “new” anymore. But compliance with an ever-evolving set of regulations and guidance is still on the front burner for corporate tax professionals—and is likely to stay there for quite a while. As with so many tax issues, the best way to ensure compliance is to make a checklist. In the case of the TCJA, however, that’s easier said than done. We put together a roundtable of experts to find out their thoughts about how to develop that checklist. They are Nancy Chassman, partner at Roberts & Holland LLP; George Farrah, vice president of content and analysis at Bloomberg Tax; Councill Leak, senior vice president and tax director at Leidos; and Elizabeth Sponsel, partner and national leader, corporate tax office, at RSM US LLP. The roundtable, which took place in November 2018, was moderated by Michael Levin-Epstein, senior editor of Tax Executive.

Michael Levin-Epstein: What are the major content areas that would inform a TCJA checklist?

Elizabeth Sponsel: Of course, domestically, tax reform has a significant impact on various areas such as choice of entity, bonus depreciation, business loss deduction, meals and entertainment deductions, and Section 199A. But for some it is even more significant on the international side—given GILTI, BEAT, FDII, and the repatriation tax—since this requires taxpayers to think through structural implications, as well as the specific tax attributes, in order to best take advantage or minimize negative impact of the new legislation. It requires taking a step back and asking “What can we do from a planning perspective, what will this mean to the business, and who needs to know about this now?” in addition to thinking about how best to comply with the new regulations.

Nancy Chassman: I would agree that the areas Elizabeth highlighted certainly are going to be at the top of a TCJA compliance checklist. These areas will also be a focus of the IRS when a taxpayer’s audit cycle hits for the years under the 2017 tax reform. On the domestic side, I think the IRS is likely to scrutinize Section 199A, specifically whether taxpayers are accurately representing income as being generated from a trade or business that is eligible for the deduction. On the international side, Section 965, the repatriation of foreign E&P, the IRS will be looking at the E&P and PTI calculations that the taxpayers have done. It is likely that the IRS will also focus on audits of the valuation methodologies used by taxpayers in determining amounts under the GILTI and FDII provisions.

“We don’t have an especially large tax department, so we didn’t form a special group. Rather, all of my direct reports were engaged in the process.”

—Councill Leak

Councill Leak: The content areas noted by Elizabeth and Nancy are prominent in the Tax Act checklist that Leidos created early in 2018. We will use the checklist over the next few months to help us make sure our year-end tax accounting is complete and to finalize any true-ups to the initial accounting for the Tax Act implementation in 2017. The SEC gave companies one year to true those calculations up under SAB 118, and that deadline ends December 22. So, calendar-year companies must finalize and document many complex calculations, and a comprehensive checklist can be useful for organizing that effort. My team and I will continue to study all of the Tax Act guidance the IRS has issued over the past few months and that it is expected to issue in December. We plan to create a new checklist to capture the key elements of 2018 IRS guidance relevant to Leidos, and we will use it during the preparation of our 2018 income tax provision.

George Farrah: I agree with what’s been said. I think clearly the international components of tax reform are the headline of what’s happened. There are so many other moving parts. We’re hearing a lot from our subscribers about 163(j), and we’ve just had proposed regulations on that. That’s an area that I think is of primary concern. We’ve also been hearing a lot from our customers about other things such as the new 199A deduction and other aspects of choice-of-entity, and the changes to travel and entertainment and how to implement those changes. I think there are so many different parts to tax reform, it depends on which industry you’re in, what businesses you have, and what your particular situation is as to how it’s going to impact you. I think it is important to go through all of the components of tax reform, which hopefully most people have done but will continue to do as guidance comes out to see how it impacts them.

Sponsel: We are just starting to get a glimpse of what next year is going to look like from a compliance standpoint, also. Dave Kautter, Assistant Secretary of the United States Treasury, was quoted last July (while the acting commissioner of the Internal Revenue Service) that the IRS estimated they would need to amend as many as 450 forms, instructions, and publications in order to implement tax reform. One great example of how significant this is to taxpayers is the recently released Form 5471. The new form has a lot of our clients already rethinking their processes and the changes they will need to implement in order for the required information to come together in a timely way. And that is just one form! Plus there is a growing level of nervousness, at least within my firm and amongst my largest corporate clients, about how timely IRS is going to release updated forms and the impact this will have on everyone’s ability to get ahead of all of the new reporting requirements without creating too much chaos along the way.

Integrating a Checklist Into Business Operations

Levin-Epstein: That’s a great point. Let’s talk about how to go about constructing a checklist. Conceptually, how would you advise taxpayers to go about the business of developing that checklist, and who should be involved in the process?

Chassman: When thinking about a checklist, it is important—and this is something that we spoke about during our panel at the TEI conference—for taxpayers to be constructing a checklist that takes into account both the current return filing obligations and a later IRS audit of the return. Right now the focus is on compliance, and rightfully so, because of the dramatic changes that have to be implemented by taxpayers on a short timeline, in both the foreign and domestic areas. But taxpayers also should be thinking ahead to the IRS exam that’s going to come down the pipeline not too long after implementation and preparing audit-ready files. This means organizing and maintaining files with detailed computations and backup to support the numbers, and documenting legal positions with memoranda that includes factual support and thoughtful legal analysis to be ready for the IRS examination. Taxpayers should anticipate IDRs on the items in the legislation that have most impacted the tax picture of their organization and be ready with substantiation and support for the losses, deductions, expenses, etc. relating to those provisions in the legislation.

“A mock audit will give taxpayers insight into where there may be shortcomings in their documentation or legal position, so they can address issues before the audit starts. That’s something that corporate taxpayers may want to consider as well.”

—Nancy Chassman

Leak: I’ll give a practical answer for how Leidos constructed its Tax Act implementation checklist. First off, as we talked about at our panel, George’s firm, Bloomberg Tax, did a great job preparing and publishing a Tax Act analysis point-by-point document soon after the December 2017 law was enacted, so we used that content to build an Excel-based tracking checklist to identify the law changes that we believed applied to us and to assign responsibilities for further research and analysis. During the course of preparing our 2017 income tax provision, we used the checklist to capture the results of that research and to document the tax provision impact. Due to the large amount of IRS Tax Act guidance issued in 2018, I have asked my tax planning team to create a second Excel-based checklist. As George mentioned, there have been numerous proposed regulations issued in recent weeks to provide taxpayers with Tax Act guidance, most notably for changes to international tax rules and to Section 163(j). The IRS lists all newly issued guidance on its website, so we’re creating a second checklist to cross-check to the IRS guidance list and to document expected tax return and tax provision impacts. That’s one way to ensure that we’ve considered all of the Tax Act changes and to document the analysis. I expect our year-end financial statement auditors will be asking us if we’ve considered all of the new Tax Act rules and proposed regulations, and we will use both checklists to demonstrate that we have.

Farrah: I was just going to add to what Councill said about the tool that we created, our Tax Reform Roadmap. It is, I think, a great starting point for creating a checklist at a macro level and helps to ensure that all the different parts of tax reform have been considered. I think that, ultimately, you will need to dig down deeper on the various areas that will, or possibly could, have impact and develop more detailed checklists. We also have prepared an IRS Guidance Roadmap, too, as a companion piece, similar to what Councill was just mentioning, not only about tracking what tax reform did, but also what guidance has come out since then. We want to make sure that we keep our customers fully informed. So as people look at various areas of tax reform and consider what open questions there are, they can track that with a checklist. I’m sure companies are mapping out how the changes would impact their company under various scenarios so that when regulations do come out, they are able to quickly assess the impact and be able to report that up the chain. We’re doing a roadmap for how states have responded, because I don’t think we can ignore what the states are doing in response to tax reform and whether they will or will not conform to certain areas or how it’s going to impact state-level taxation.

Chassman: I think George is absolutely right. Taxpayers should be keeping an eye on the state tax implications. As an example, New York recently enacted the Employer Compensation Expense Program, which commences in 2019 but actually had a December 1, 2018, deadline to take advantage of the 2019 rollout. This program provides New York employers with the opportunity to ease some of the federal legislation’s impact on the $10,000 cap on the deduction for state and local tax. It effectively shifts a portion of the employee’s state tax burden to the employer, since payroll taxes are not subject to the cap. The phase-in goes from 1.5 percent in 2019 [to] three percent in 2020, and then [to] five percent in 2021 and thereafter. That’s something that if employers haven’t considered for 2019, they can review it for next year. Just to pick up on something else that George and Councill were discussing with regard to corporate taxpayers’ checklists: one thing that corporate taxpayers may consider is engaging in a mock audit. A mock audit is a taxpayer-initiated review of its tax return looking at it from the IRS perspective, and anticipating IDRs in areas that the IRS is likely to focus on. A mock audit will give taxpayers insight into where there may be shortcomings in their documentation or legal position, so they can address issues before the audit starts. That’s something that corporate taxpayers may want to consider as well.

“We’re doing a roadmap for how states have responded, because I don’t think we can ignore what the states are doing in response to tax reform and whether they will or will not conform to certain areas or how it’s going to impact state-level taxation.”

—George Farrah

Sponsel: Going back to the tax return compliance perspective, one of the things that we’ve heard our clients asking about lately relates to the timing of tax compliance software updates. For many, this is a key consideration as they prepare for their annual tax software rollover; they want to understand how best to use the software to account for things such as the Section 965 on their E&P pools—better to adjust before or after rollover? We continue to advise our clients to reach out to their particular software vendor, in addition to our own inquiries. The more we all raise the same questions, the more the vendors will see the need to be transparent about their plans as well as the need for providing best practice guidance around how to use existing software features to implement tax reform accurately and completely.

Stakeholder Involvement

Levin-Epstein: Should this process be part of your overall business operations or delegated to a special group within your organization?

Leak: Here is how Leidos is approaching this: We don’t have an especially large tax department, so we didn’t form a special group. Rather, all of my direct reports were engaged in the process. Each of them manage a specific functional tax area within the department. My head of tax planning and audits and his staff took the lead in pulling together the Excel-based Tax Act implementation checklist. Then his team partnered with the head of income tax compliance and the head of income tax accounting and their staffs to analyze and understand the scope of the Tax Act and the regulations and to document how the rules apply to their respective areas. The Tax Act has broad implications for how all U.S.-based multinational businesses will operate going forward now that the U.S. has moved from a worldwide corporate tax regime to a “quasi-territorial” tax regime. This change alone will have a big influence on how companies structure cross-border M&A transactions. Likewise, the changes that allow for 100 percent expensing for machinery and equipment, coupled with the new interest limitation rules, will dramatically affect domestic M&A decisions. So, I think company tax leaders need to come up with a plan to educate their peers in various parts of the enterprise who need to be aware of the new tax law and how it’s going to impact business investment decisions going forward.

Sponsel: Just to add onto what Councill said regarding those areas: the other stakeholder that we see getting involved in developing checklists, of course, is the role of the tax technologist. Their input on the best data sources for new disclosures and reporting requirements is key. If this role is not someone within the organization, then it means reaching out to advisors and consultants to add this perspective into the planning process so that the organization has a complete understanding from the new regulations all the way through to e-file and financial statement releases.

Levin-Epstein: That’s a good way to end the discussion.