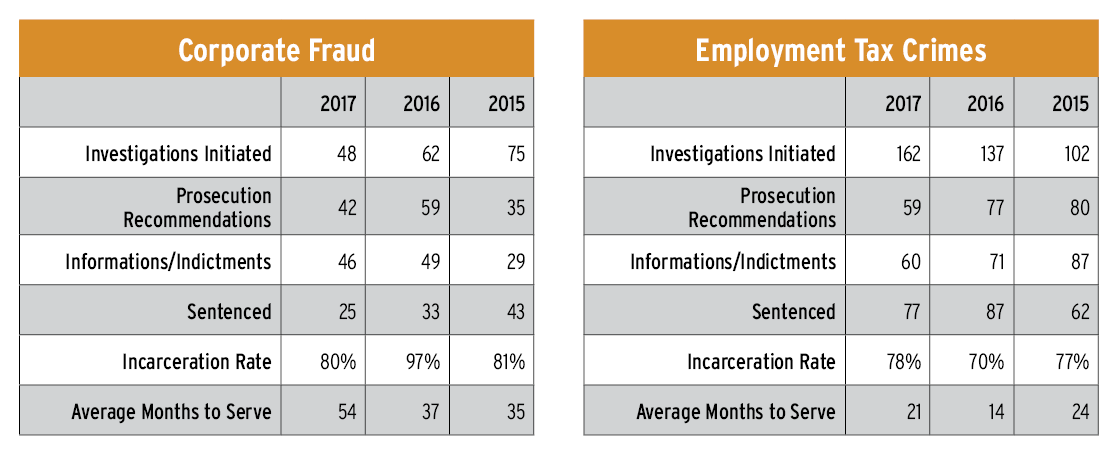

Later in this issue of Tax Executive, you will read an article by an Alston & Bird tax professional on the subject of tax evasion, a serious crime. According to the IRS Criminal Investigation Division’s 2017 Annual Report, in 2017 alone 1,811 of the 3,019 investigations it initiated were for tax crimes. Of those, there were 1,196 indictments and 1,303 sentences issued. Crimes included employment tax fraud, identity theft, and data compromises, among others. These statistics include both individual and business crimes, with individual crimes predominating. But no matter how you separate the data, all of these crimes could mean jail time. Below are the reported figures for corporate fraud and employment tax crimes in 2017, according to the appendix of the report.

(www.irs.gov/pub/foia/ig/ci/2017_criminal_investigation_annual_report.pdf)