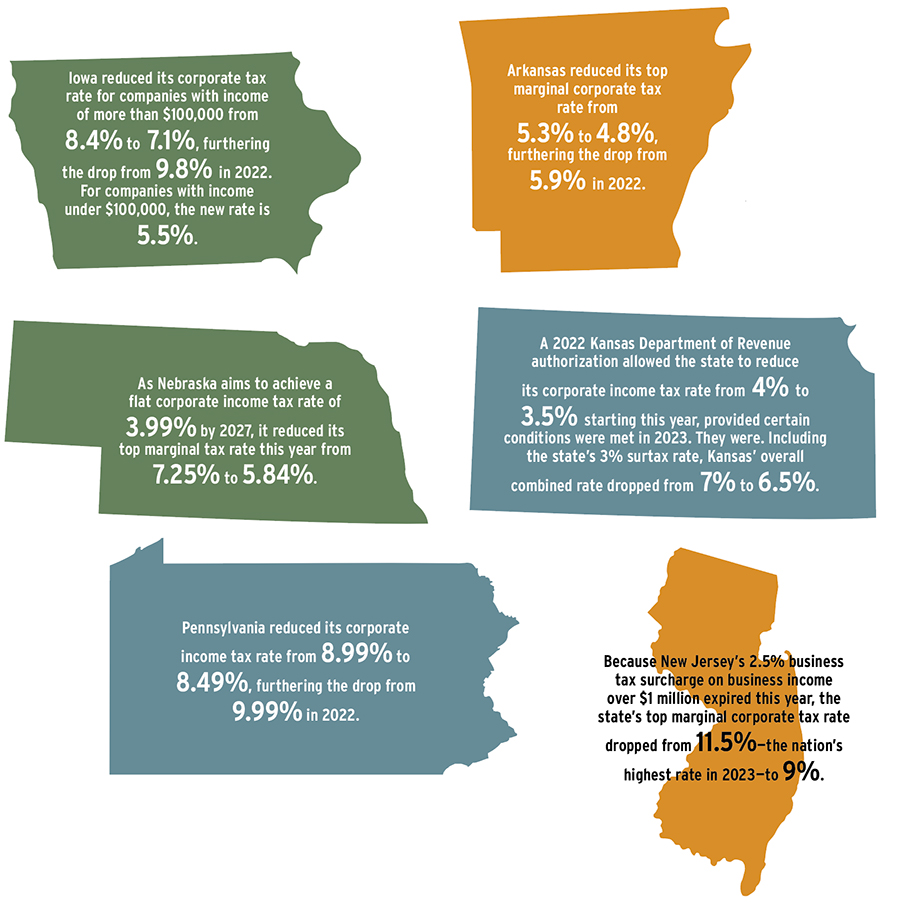

Spurred by their emergence from the COVID-19 pandemic with revenue surpluses and a drive to mitigate the effects of inflation, states continue to ride waves of reform in 2024. This year, thirty-four states made changes to their tax codes, effective January 1. As detailed here, six states—Arkansas, Iowa, Kansas, Nebraska, New Jersey, and Pennsylvania—have reduced their corporate income tax rates.

For a more thorough rundown on this year’s state tax updates, visit https://taxfoundation.org/research/all/state/2024-state-tax-changes.

Source: Tax Foundation, “State Tax Changes Taking Effect January 1, 2024,” https://taxfoundation.org/research/all/state/2024-state-tax-changes.