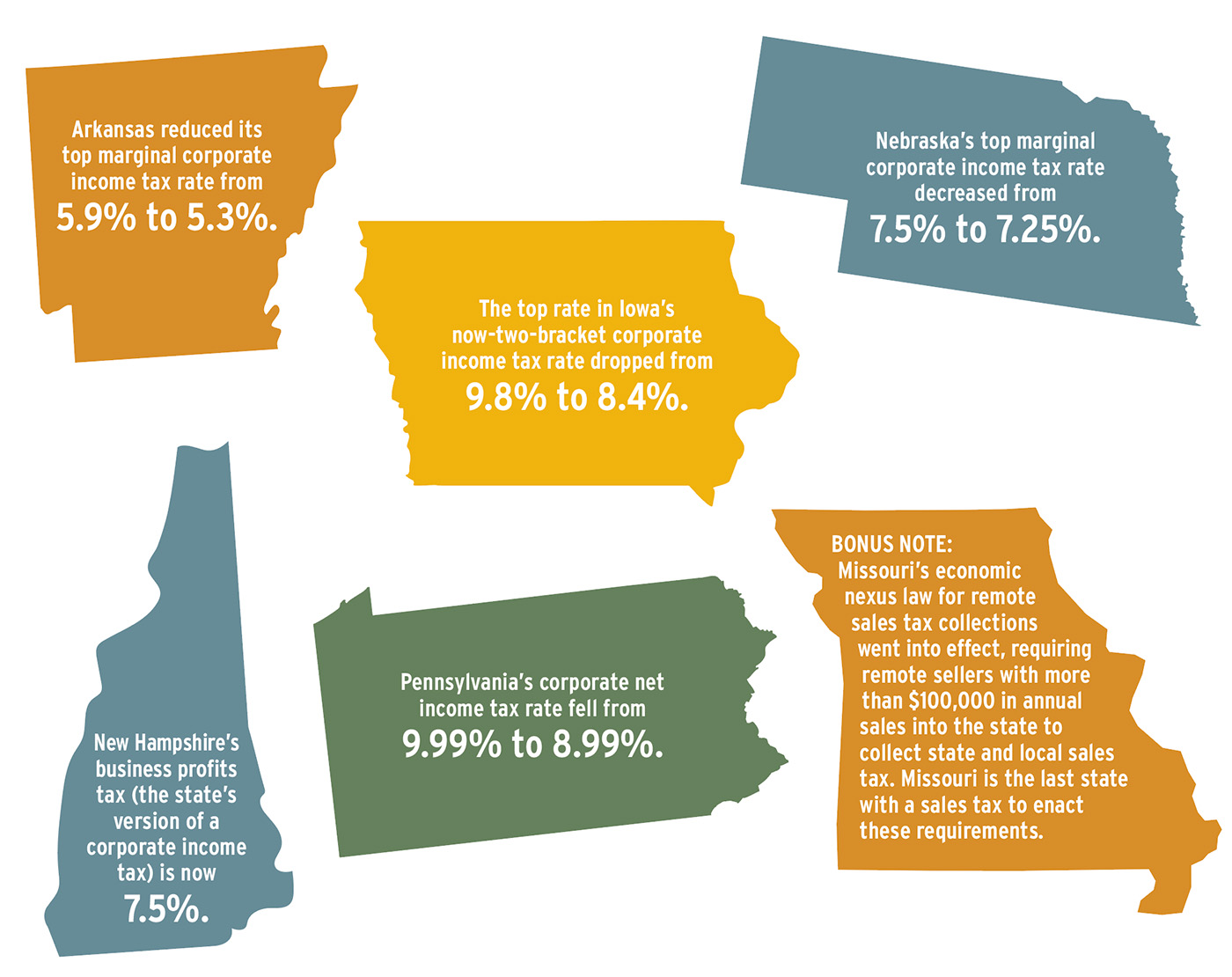

Thirty-eight states rang in the new year with significant changes to their tax codes. Most of these state-level changes were spurred by a wave of rate reductions and other tax cuts over the past two years, greater tax competition during a time of greater mobility, and, of course, inflation, according to the Tax Foundation. Although most of the adjustments will be felt at the individual level—income, sales, use, and excise taxes—the corporate tax realm saw several rate shifts. Some shifts, such as Nebraska’s reduction of its top marginal corporate income tax rate, are part of past legislation that includes phasedowns over several years.

A handful of state-level corporate income tax changes are highlighted below. For a full rundown of each state’s tax adjustments this year, visit https://taxfoundation.org/2023-state-tax-changes.

Source: Tax Foundation, “State Tax Changes Taking Effect January 1, 2023,” https://taxfoundation.org/2023-state-tax-changes/.