Today’s corporate tax professional faces many compliance challenges, from the evolving regulatory landscape to complex data management issues. Generally accepted accounting principles (GAAP), international financial reporting standards (IFRS), and local statutory requirements create many standards for multinational tax departments to understand and reconcile. Increasingly, globalization leads to day-to-day language, time zone, and operational challenges.

Today’s corporate tax professional faces many compliance challenges, from the evolving regulatory landscape to complex data management issues. Generally accepted accounting principles (GAAP), international financial reporting standards (IFRS), and local statutory requirements create many standards for multinational tax departments to understand and reconcile. Increasingly, globalization leads to day-to-day language, time zone, and operational challenges.

The volume of business data is growing exponentially. Tax professionals need to comb through data at an accelerated pace, which makes it difficult to ensure that all events are treated properly for their tax implications.

Perhaps the biggest challenge is the difficulty in consolidating and reporting data that is stored across multiple tax systems—a task that is becoming a more critical need with policies such as the base erosion and profit-shifting (BEPS) guidelines from the Organization for Economic Cooperation and Development (OECD). Global statutory reporting is also becoming more complicated, as is the connection between tax and accounting.

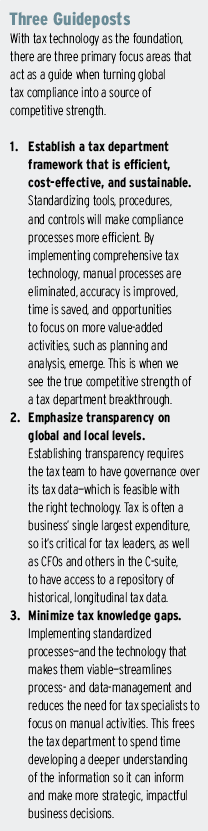

Given these challenges, it is no wonder that the primary goal with global tax compliance is simply to keep your head above water. But what if compliance could become a source of competitive strength within your organization? Getting there starts with your organizational model. Coordination is key when it comes to working effectively with others in finance and local offices to ensure all tax-related information is accurately represented.

While organizational structures will change over time, the foundation for making global tax compliance a competitive strength lies in implementing the right tax technology. A comprehensive tax-compliance solution enables your tax department to “own” its tax data in a way that creates value. A well-implemented technology solution will consistently provide your tax department with increased accuracy, visibility, and transparency.

Having data in a centralized, auditable system of record, with notes and documentation, can take the guesswork out of understanding what was done in a prior tax year and the stress of an audit by tax authorities. The result is a structured and rewarding work environment that decreases burnout and increases the chances of retaining good employees.

Making It Work for You

Each of the focus areas are underpinned by comprehensive tax technology.

To make the most impact on your global tax compliance activities, the solution you choose should be comprehensive—meaning complete document management; compliance reporting; process management; and research, guidance, and training tools. Applications should have global capabilities as well as a local focus. More general functions should be global and used across the solution suite, while country-specific offerings are also available to meet local needs. This allows you to maintain accurate and seamless compliance; stay ahead of increasingly complex international tax laws; and manage your filing obligations in numerous local jurisdictions while addressing challenges around language, currency, and regulatory changes.

The tax technology solution you choose should also be scalable, with the ability to access information from the top down and bottom up. You should be able to drill down from high-level global compliance activities that span multiple regions and move up from specific local compliance activities—with the same data flowing through seamlessly. This, coupled with anytime–anywhere access to your tax data, is crucial in bringing your global compliance activities full circle.

Moving to a Position of Strength

Deploying the right technology strategy can transform compliance data requirements into intelligent information that empowers your tax department and your company to have a competitive distinction over others. With a focus on transparency and standardization, you can use technology to build a sustainable, flexible foundation that will allow your tax department to minimize knowledge gaps and focus on strategic activities. The result is a stronger global compliance process and a value-driven tax department that will stand the test of time.

Liz Taxin is managing director of Global Compliance and Reporting Technology at Thomson Reuters.